AI Agents and AI Agent Frameworks in Production Survey, Part 1

Generative AI has been championed as a key catalyst for business transformation, with recent industry analyses arguing it could reshape everything from salesforce automation to higher education. A Forrester whitepaper suggests that generative AI is now beyond the experimental phase, fueling a wave of automation across contact centers and back-office tasks. Insight Partners, meanwhile, highlights AI agents as disruptors that can potentially streamline workflows and spark new revenue opportunities—particularly in verticals like finance, logistics, and healthcare. Even education is on the cusp of transformation: a recent Forbes piece forecasts that AI agents will permeate every facet of learning by 2025, signaling broader societal shifts in how we acquire knowledge. Yet not everyone is sold on the rosy outlook—analysts are also warning that the hype around AI-driven solutions may outpace real-world returns, leaving investors cautious.

In November 2024, YouGot.us surveyed over 300 practitioners during a Prosus/MLops.Community Event about AI Agents in Production, to see who is implementing AI agents in day-to-day operations, how they are doing it, and what’s holding them back. Are high-level executives taking the plunge, or are AI/ML engineers steering the strategy? Why do some industries greet AI agents with open arms while others stay on the sidelines? Most importantly, how does actual adoption stack up against the hype? This report aims to answer these questions, providing a data-driven perspective on whether AI agents truly live up to their promise—and what it will take to make them indispensable across sectors.

Chapter 1: What Are AI Agents?

While the term “agent” can conjure images of chatbots or automation scripts, modern AI agents are significantly more advanced, capable of interpreting complex inputs, making decisions, and sometimes even executing tasks independently. According to Anthropic’s paper on Building Effective Agents, these agents are “designed to reason about states, actions, and outcomes in a robust, interpretable, and safe manner.” Put simply, an effective AI agent isn’t just a static model—it’s a system that can plan, adapt, and refine its behavior based on goals and real-time feedback.

Key Characteristics

Autonomy – AI agents can function with minimal human intervention. They observe the environment (or data), weigh possible actions, and choose how to proceed.

Goal-Oriented Reasoning – Whether it’s responding to customer queries or generating code snippets, agents operate under clear objectives, using AI-driven logic to reach those goals.

Contextual Awareness – The best agents integrate contextual or domain-specific knowledge, filtering out noise and focusing on relevant signals.

Safety & Interpretability – As Anthropic underscores, robust safety mechanisms and transparency in decision-making are essential. AI agents should be designed to minimize harmful or biased outputs while making it easier for developers to trace how decisions are made.

Why This Matters

AI agents offer more than just automated chat or rote scripting. By operating with an internal model of the world—or at least the data they’re trained on—they can handle tasks that once demanded human judgment and domain knowledge. This shift is already evident in areas like code generation, customer support, and advanced analytics. However, as our survey findings will show, adopting such agents at scale comes with organizational, technological, and ethical challenges. Understanding their potential and limitations is the first step in navigating these complexities.

Chapter 2: Who’s Driving AI Agents?

One of the most significant insights from YouGot.us’ November 2024 survey of over 300 practitioners involves identifying exactly who is pushing AI agents forward. While some might assume that only cutting-edge startups would invest in this emerging technology, the reality is more nuanced. Adoption patterns cut across industries and company sizes, with roles spanning from entry-level developers to C-suite executives. Understanding these demographics is crucial because it sheds light on how decision-making is happening, who has the authority to allocate budgets for AI initiatives, and which industry sectors are leaning into AI agents with the greatest enthusiasm—and why.

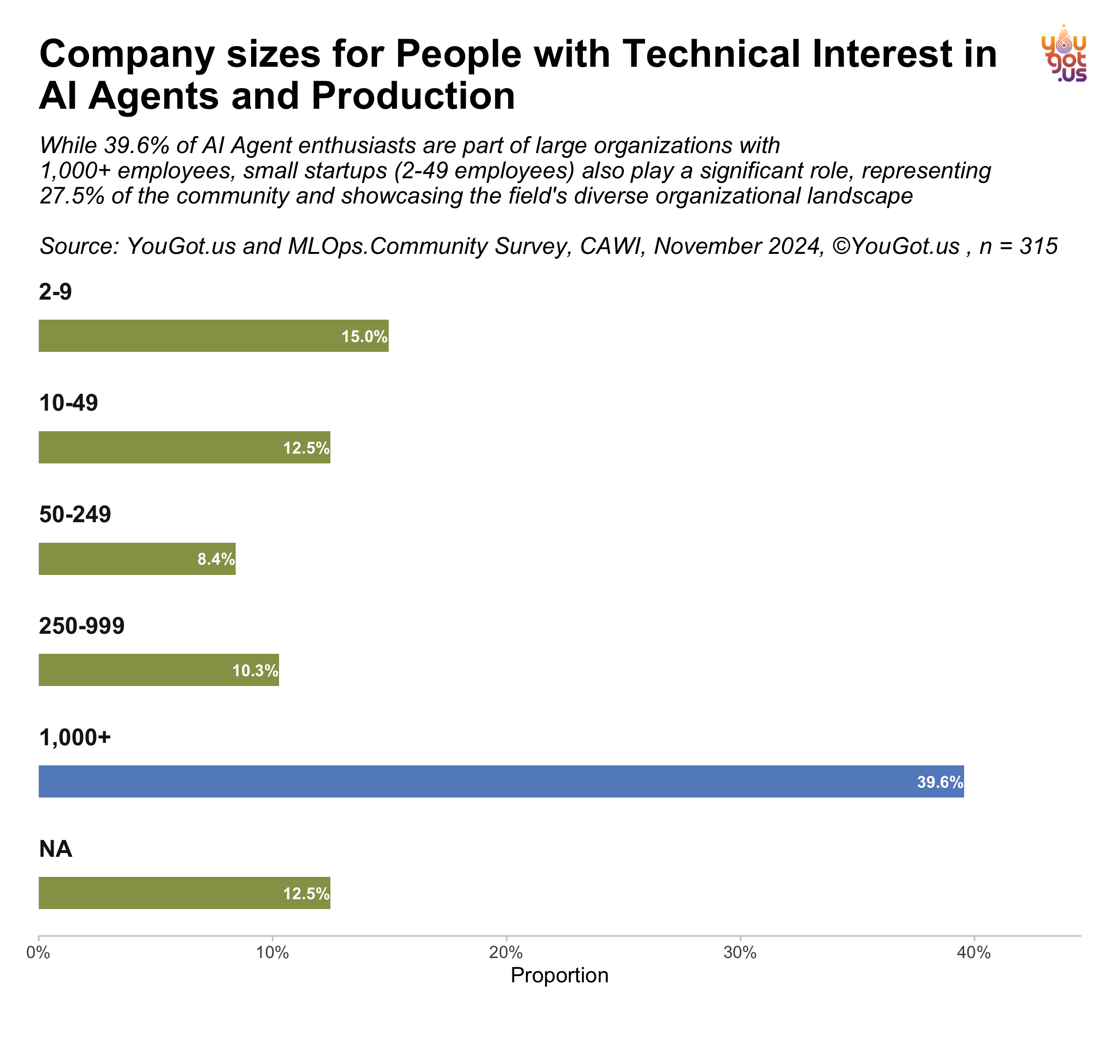

Company Sizes Represented

Our survey also breaks down participants by company size, illustrating a balanced mix of startups, SMEs, and large enterprises. Notably, 39.6% of respondents come from organizations with 1,000+ employees, highlighting that bigger companies are actively investigating or deploying AI agent solutions. At the other end of the spectrum, 27.5% hail from small startups (2–49 employees), showcasing their agility in early experimentation—fewer bureaucratic hurdles and quicker decision-making often help them pilot new technologies faster.

Yet, the role of large enterprises cannot be understated. While they face more complex decision-making structures, they benefit from robust infrastructure, established data pipelines, and the capital to fund specialized teams, from MLOps engineers to AI ethics experts. Moreover, once a project at a large organization obtains executive buy-in, it can be rolled out at massive scale—potentially delivering outsized ROI. Ultimately, this spectrum of company sizes underscores the diverse environment in which AI agents are taking root, from lean startups to multinational corporations.

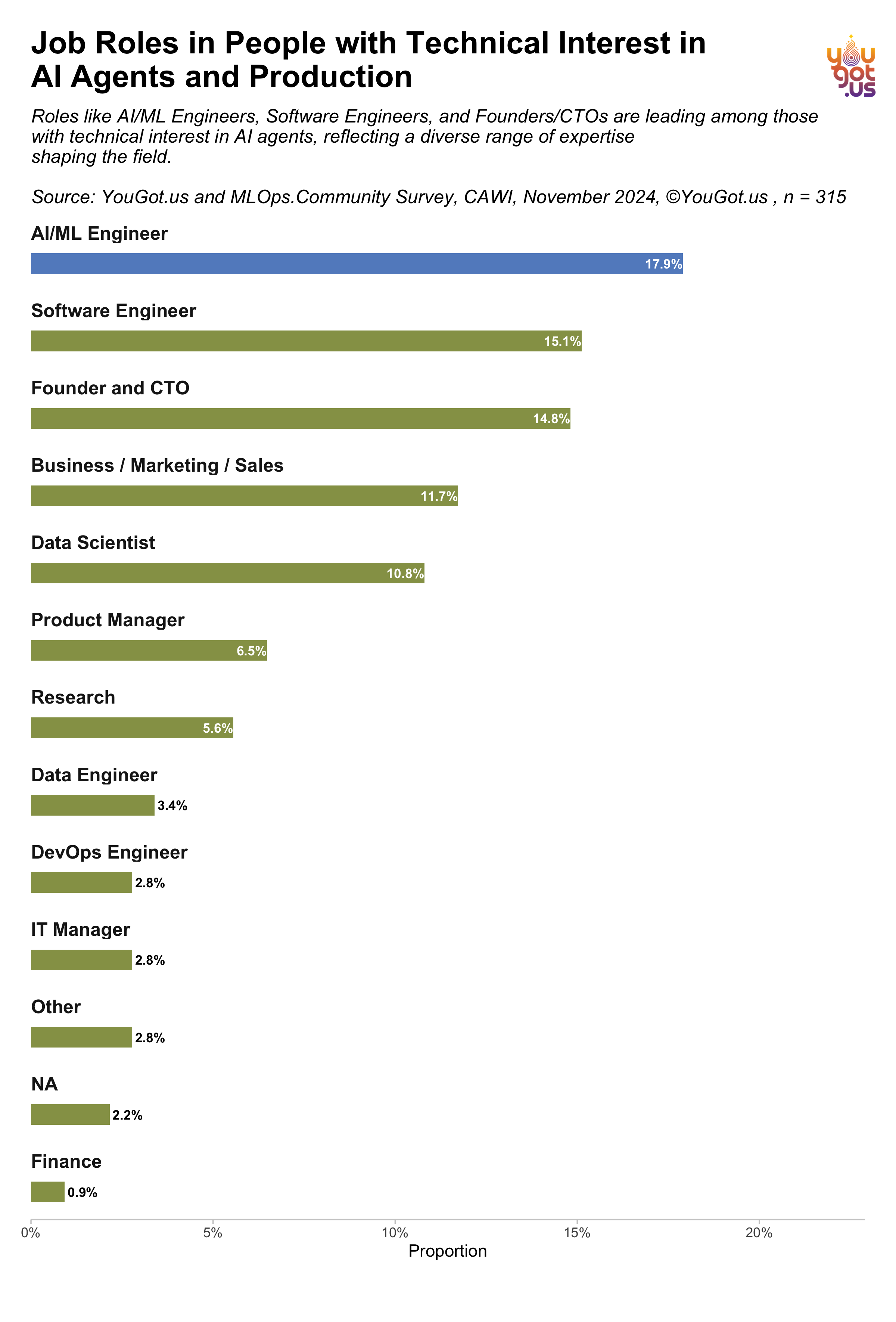

The Roles Behind AI Agents

The first lens we used to examine the survey data was by respondents’ professional roles. AI/ML Engineers make up the single largest group at 17.9%, which is hardly surprising—these professionals have deep technical expertise and a vested interest in leveraging AI agents to automate repetitive model-building or data-processing tasks. Software Engineersfollow close behind at 15.1%, underscoring their key role as the bridge between pure research and production systems. Their insights help shape how AI agents integrate with existing codebases, deployment pipelines, and user-facing applications.

We also see that Founders, CTOs, or similar executive-level decision makers form 14.8% of the respondent pool. In this study, these startup leaders are not only guiding the strategic “why” behind AI agent initiatives but are also directly involved in the “how.” Although they keep the bigger picture in mind—assessing ROI, evaluating competitive positioning, and aligning with business strategy—they also dive into hands-on implementation, often with limited resources. Their significant presence in the survey underscores a clear sense of urgency around integrating intelligent automation as a key differentiator in startup environments.

Looking beyond these top three categories, there is a substantial contingent in Business/Marketing/Sales roles (11.7%) and Data Scientists (10.8%). The presence of non-engineering professionals, including those on the marketing and sales side, signals that AI agents are resonating across diverse business functions—beyond mere technical exploration. Meanwhile, data scientists’ involvement further underlines the broadening scope of advanced analytics and experimentation with AI-driven tools.

Overall, the breadth of roles represented in our data underscores that AI agents are not just the domain of data scientists. From engineers integrating third-party APIs to executives pondering which AI investment will yield the highest dividends, a cross-section of talents and responsibilities is coming together to drive this technology forward.

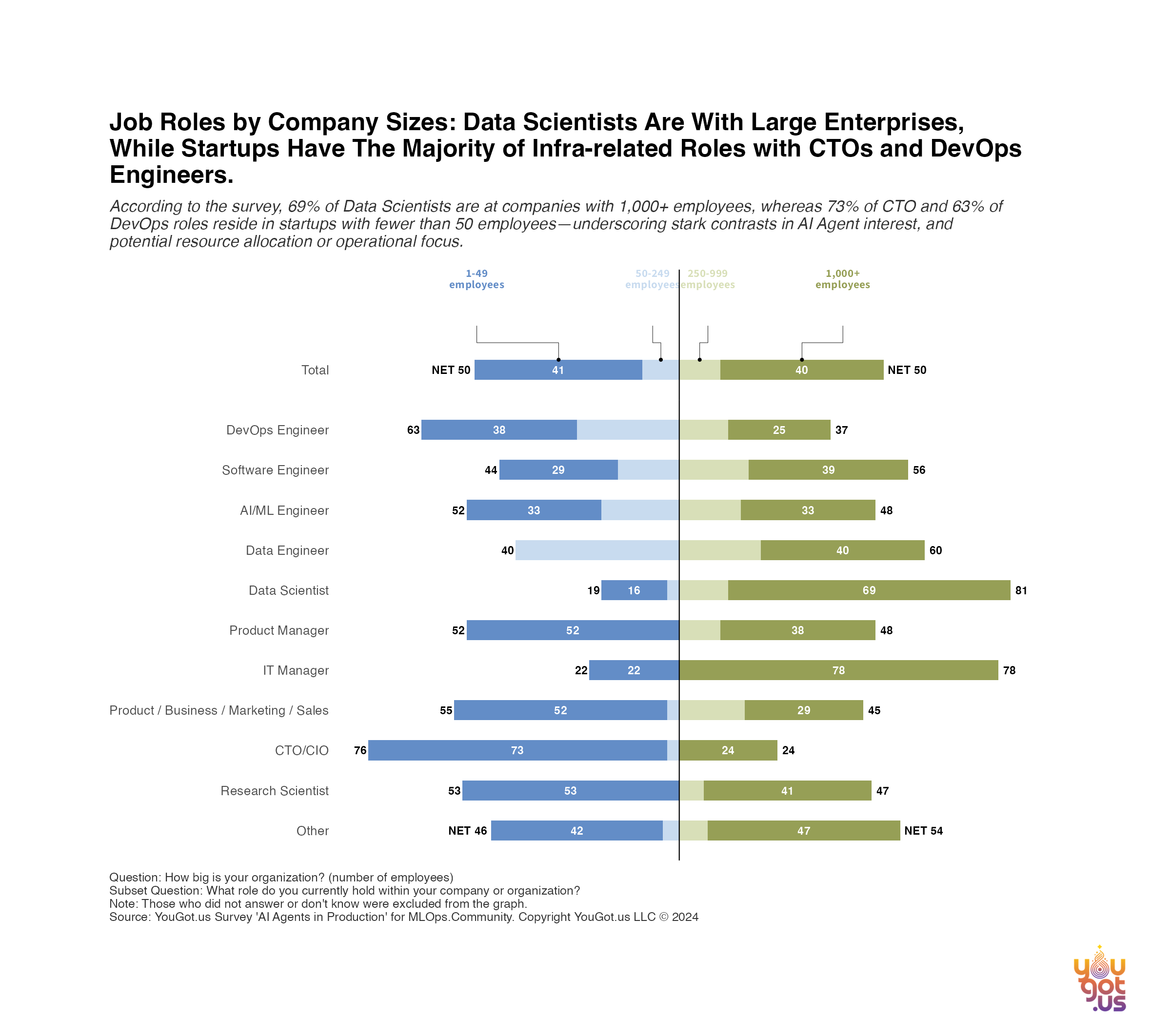

How Roles Vary by Company Size

A closer look at our survey data reveals striking contrasts in how roles map to different organization sizes:

Data Scientists: Within our sample, 69% of respondents in this role work at enterprises with 1,000+ employees, suggesting that larger corporations in our data place a heavier emphasis on advanced analytics.

CTOs and DevOps Engineers: For companies with under 50 employees, 73% of CTOs and 63% of DevOps Engineers are found in startups, indicating a need for versatile, infrastructure-focused leaders who can manage both direction-setting and day-to-day deployments.

Software Engineers, AI/ML Engineers, and Product Managers: These roles appear more evenly distributed across mid-sized companies (50–999 employees), suggesting a transitional environment where teams are scaling up but not yet as specialized as those in large enterprises.

Such patterns hint at how in our dataset, priorities differ by company size. Early-stage organizations often rely on multi-skilled personnel to drive rapid experimentation, while larger enterprises invest in specialized talent to handle complex data, compliance, and organizational structures.

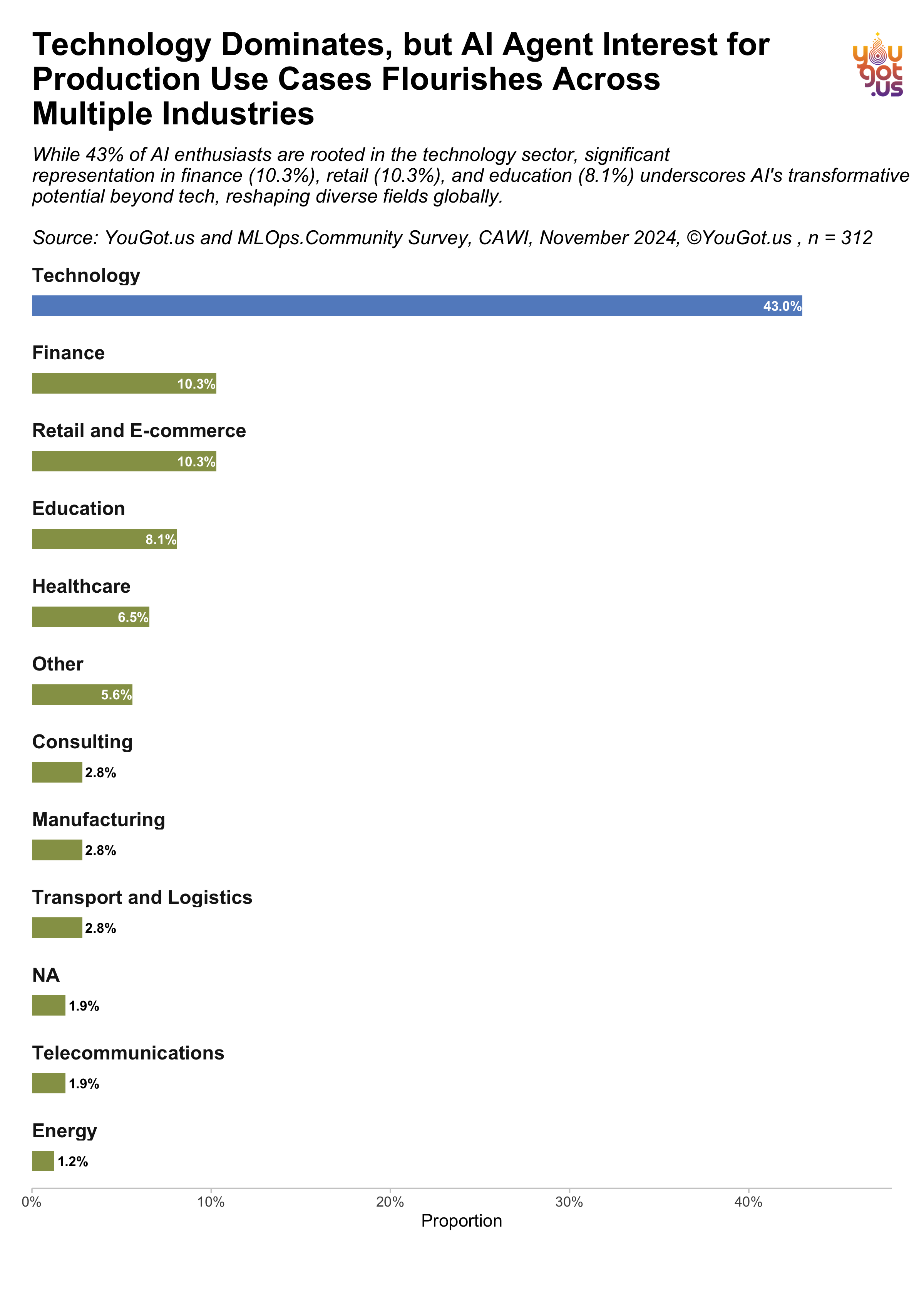

Leading AI Agent Industries: Tech, Finance, and Beyond

When it comes to industry representation, Technology indisputably leads the pack at 43%, with many respondents working in software development, cloud infrastructure, or related fields. This concentration in the tech sector is no surprise: these organizations often have more experience with early-stage innovation, faster iteration cycles, and a culture that prizes experimentation. Moreover, technology companies typically command deep engineering talent and have leadership that actively embraces data-centric approaches.

Still, the survey reveals strong interest beyond tech. Finance is the second-most represented at 10.3%, with respondents citing several drivers: regulatory compliance, risk assessment, and customer-facing chatbots for basic inquiries. Given their focus on risk mitigation, financial institutions emphasize that AI agents must be both secure and explainable—two qualities that can be challenging to achieve at scale. This may help explain why, despite high interest, full-scale deployments in finance often trail simpler tech-focused use cases.

Retail and E-commerce also capture slightly over 10% of responses, centered on AI agents for personalized shopping, inventory optimization, and enhanced customer service. Larger online retailers may have the resources to adopt these solutions more aggressively, while smaller businesses often adopt a “wait-and-see” stance. Although many in this sector see AI’s potential, most remain in pilot phases rather than full production.

Meanwhile, Healthcare shows 6.5% representation, highlighting a growing interest in patient triage bots, automated scheduling, and AI-enabled telemedicine support. Nevertheless, concerns about patient privacy and regulatory mandates (e.g., HIPAA in the U.S.) create additional hurdles. Here, AI agents must not only perform well but also handle sensitive data ethically and securely.

A Closer Respondent Look: AI Agents by Industry and Company Size

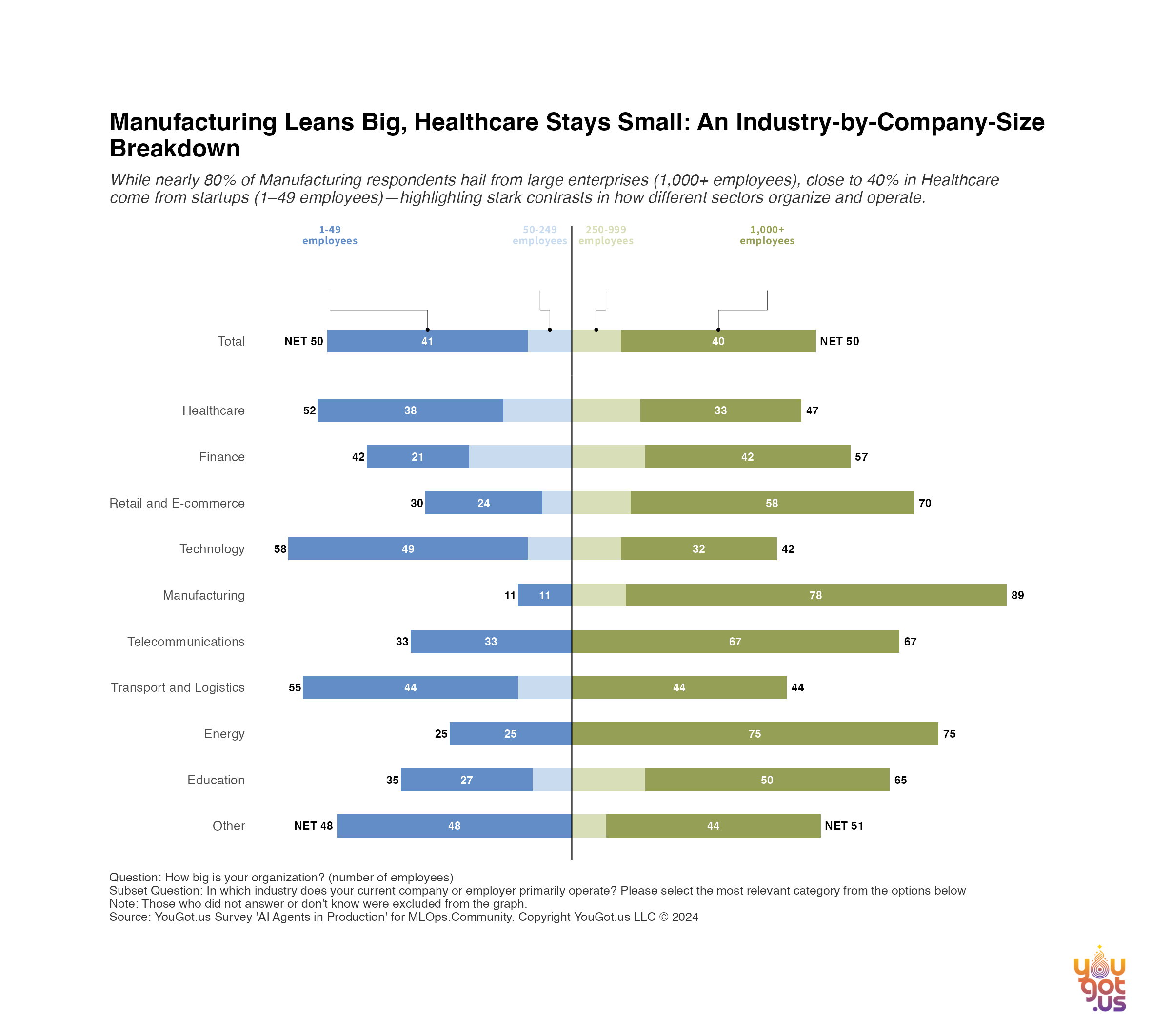

Beyond overall industry representation in our sample, the next chart shows how certain sectors lean toward particular company sizes among respondents interested in AI agents:

Manufacturing: Nearly 80% of manufacturing respondents in our dataset work at large enterprises (1,000+ employees), reflecting the capital-intensive profile of many participants.

Healthcare: Approximately 40% of healthcare respondents come from smaller organizations (1–49 employees), indicating a cluster of niche clinics, telehealth startups, or specialized providers within our sample.

Technology and Finance: These sectors in our data tend to sit in mid-sized and larger companies, though both also feature noteworthy startup participation focused on rapid innovation.

Such breakdowns highlight that within this survey, company size can influence AI agent adoption patterns differently across industries, underscoring the diverse range of organizational contexts in our sample.

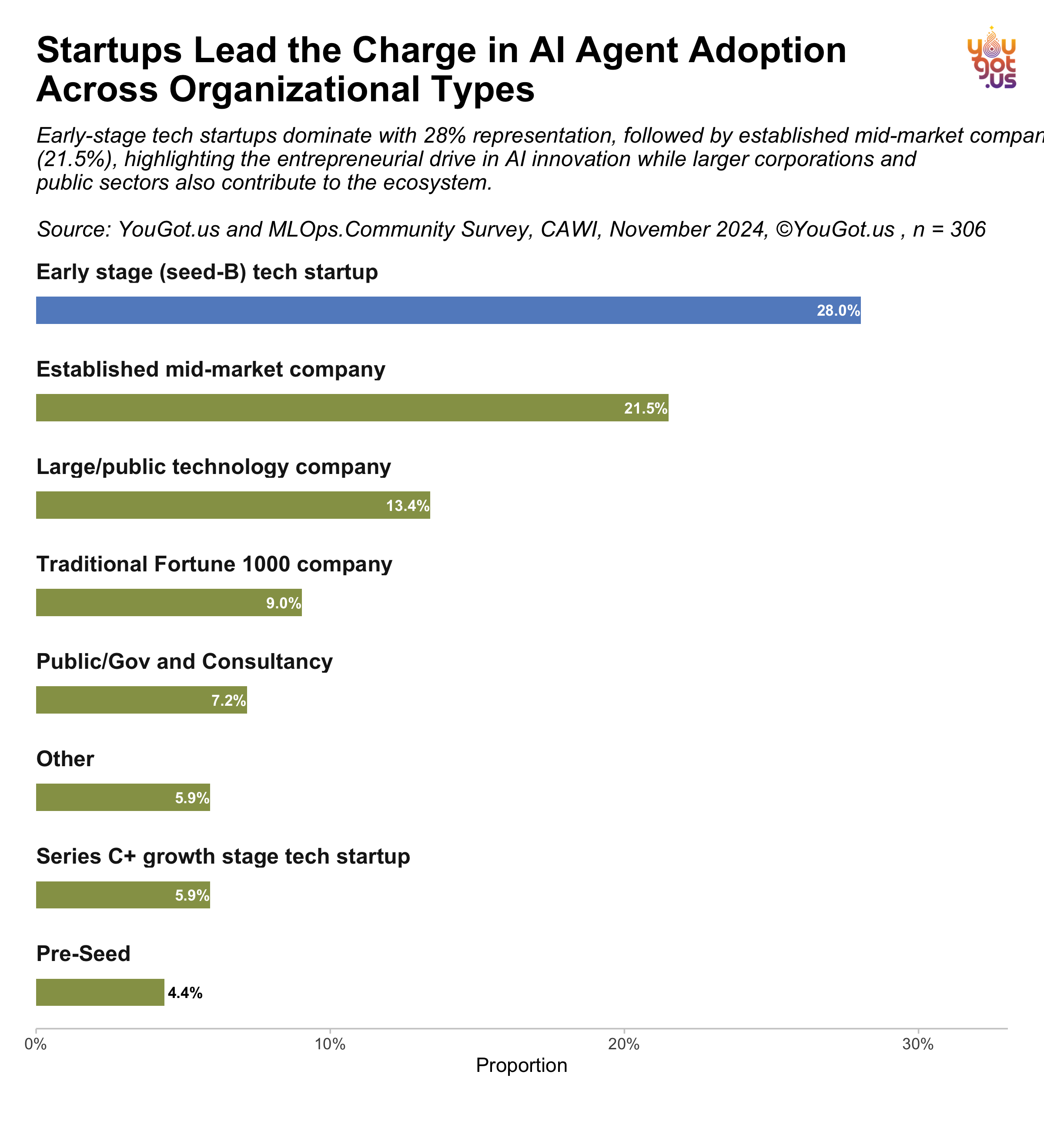

Organizational Landscape: Startup Enthusiasm Meets Enterprise Resilience

One of the interesting contrasts in the data is how early-stage tech startups (roughly 28% of respondents) perceive AI agents versus mid-market or larger organizations. Founders and CTOs from nascent ventures are enthusiastic about incorporating AI from day one, often viewing AI agents as a competitive differentiator that can help them punch above their weight in crowded markets. They cite benefits such as reduced labor costs, faster time-to-market for new features, and an “innovation halo” that attracts customers and investors.

Mid-market and large/public companies, on the other hand, often take a more methodical approach. While their executives see the potential, they must reconcile AI agent adoption with existing roadmaps, legacy systems, and an existing workforce. Moreover, these companies are less likely to pivot swiftly if initial proofs-of-concept fail. Instead, they conduct multiple pilot programs, measure outcomes carefully, and only then invest heavily in wider adoption. This step-by-step path may appear slower, but it provides stability, reduces the likelihood of miscalculations, and ultimately helps integrate AI agents into broader corporate strategies.

Interpreting the Numbers: A Convergence of Motivations

Why do such a wide variety of roles, industries, and company sizes converge on the idea of AI agents? A few underlying motives consistently crop up in our analysis:

Efficiency Gains: Nearly every segment—tech or non-tech, startup or enterprise—cites efficiency as a key driver. AI agents have the potential to automate routine tasks, freeing up human resources for more strategic or creative work.

Strategic Differentiation: Whether it’s a lean startup looking to outcompete incumbents or a large multinational aiming to stay ahead of market trends, the promise of AI agents can bolster product offerings and customer experiences.

Cost Pressures: Economic uncertainty and continuous calls for cost savings push organizations to experiment with technology that can reduce overhead, particularly for repetitive tasks like customer support triage or data entry.

Data Leverage: Many respondents see AI agents as a way to extract more actionable insights from data they already collect but underutilize. By automating parts of the analytics pipeline, they can respond more quickly to market changes.

Future-Proofing: A portion of respondents express a sentiment that adopting AI agents now will prepare their companies for a future where AI-driven workflows are standard. In their view, the risk of not experimenting is higher than the risk of limited or failed early adoption.

The Road Ahead

It’s evident from these survey results that while AI agents have captured the attention of a diverse set of roles and industries, there is still a long way to go in terms of mainstream acceptance and full-scale implementation. Some of the biggest challenges—security, scalability, organizational change management, and ROI uncertainty—will be examined in subsequent chapters. Yet the fact that engineers, executives, data analysts, and product managers alike are all expressing interest signals that the conversation around AI agents has matured beyond “novelty” status.

In the coming sections, we’ll take a closer look at the current state of AI agent adoption, including how many organizations have moved beyond piloting into full production. We’ll also explore specific use cases that are gaining traction, such as coding assistance, customer support, knowledge management, and more. By marrying the “who” (the roles and industries championing AI agents) with the “how” and “why,” we aim to deliver a 360-degree view of this evolving technology trend.

The bottom line is clear: a broad and growing coalition is driving AI agents from concept to reality. From pioneering startups seeking a market edge to established corporations navigating bureaucratic complexities, the push for AI agents is propelled by a blend of ambition, necessity, and a recognition that the future of work increasingly hinges on intelligent, automated systems. This blend of roles and industries sets the stage for a transformation in how businesses and institutions operate—a transformation whose earliest contours we’re already seeing take shape.

Chapter 3: The Current State of AI Agent Adoption

AI agents might dominate the headlines, yet our November 2024 survey reveals a more measured reality. While plenty of organizations dabble in small pilots or limited experiments, truly extensive deployments remain the exception. This chapter unpacks how many have ventured beyond experimentation and explores which organization types lead the way, the motivations fueling adoption, and the top priorities shaping AI initiatives. Ultimately, we’ll see that even as many remain cautious, there’s a clear path forming toward more robust integration in the months ahead.

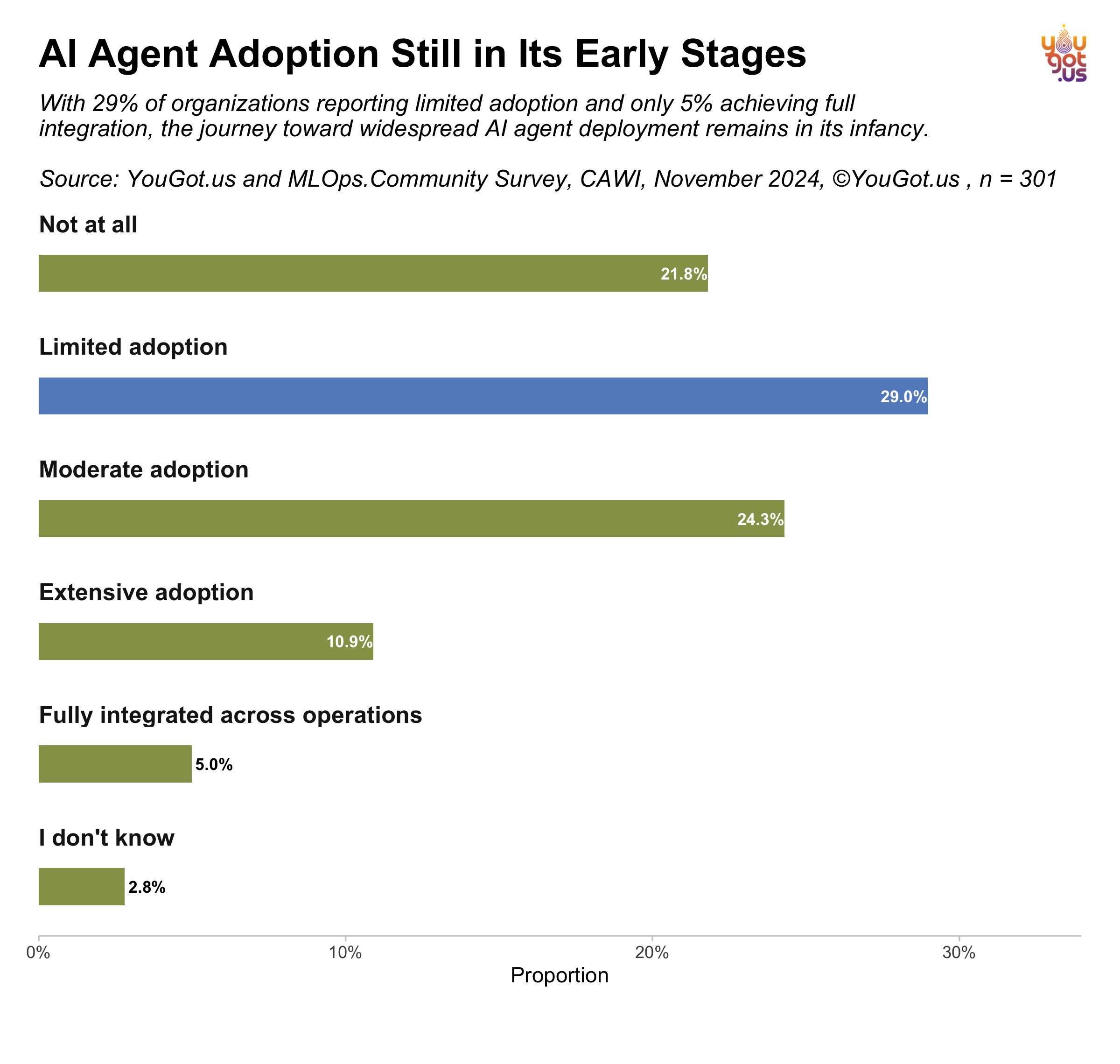

The first thing our data shows is that AI agent adoption is still nascent for a significant share of the market. Roughly 21.8% of respondents report no AI agent adoption at all, and another 29.0% say their organization uses AI agents only in a limited capacity—often in small pilots, one-off experiments, or internal proofs of concept. In total, that means half of surveyed organizations aren’t deploying AI agents in a meaningful or widespread way.

This might come as a surprise to anyone following the hype around AI. Tools like ChatGPT have indeed generated enthusiasm; however, the jump from “cool demo” to “mission-critical system” remains a leap many organizations have yet to take. Meanwhile, 24.3% report a moderate level of adoption, running AI solutions that might still be siloed or not fully integrated into the broader tech stack. Only 10.9% say they have extensive adoption, and just 5.0% report being fully integrated across operations—a small, but growing cohort showcasing AI’s potential at scale.

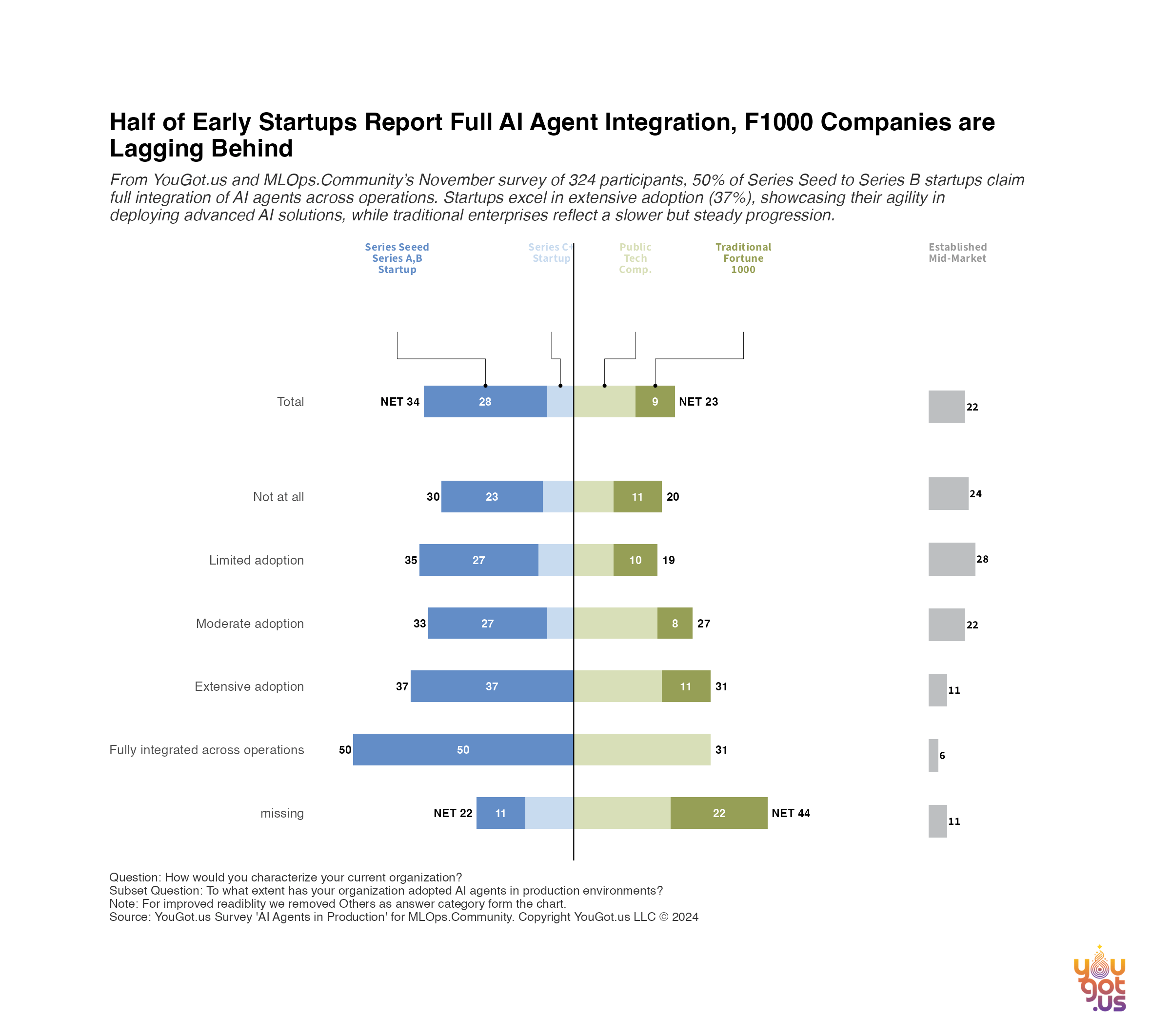

Early-Stage Startups vs. Enterprise: Who’s Leading?

A closer look at adoption by organization type reveals a fascinating split. According to our November 2024 survey of 324 participants, 50% of Series Seed to Series B startups say they’ve achieved full AI agent integration across operations. Meanwhile, established companies—especially in the Fortune 1000—tend to move more cautiously, with only 6%reporting full-scale deployment. Early-stage firms are also more likely to cite “extensive adoption” (37%) than larger counterparts, reflecting their agility and willingness to try unproven technologies for competitive advantage.

On the flip side, traditional enterprises grapple with lengthy compliance checks, rigid procurement processes, and siloed data systems. While these incumbents see the value AI agents can bring—particularly in areas like customer service or operations—they often roll out pilot programs department by department, rather than flipping the switch enterprise-wide. That said, big corporations do have the advantage of deeper pockets and more established processes. Once they decide to scale, they can bring significant resources to bear and potentially leapfrog smaller players.

Why Organizations Are Adopting AI Agents

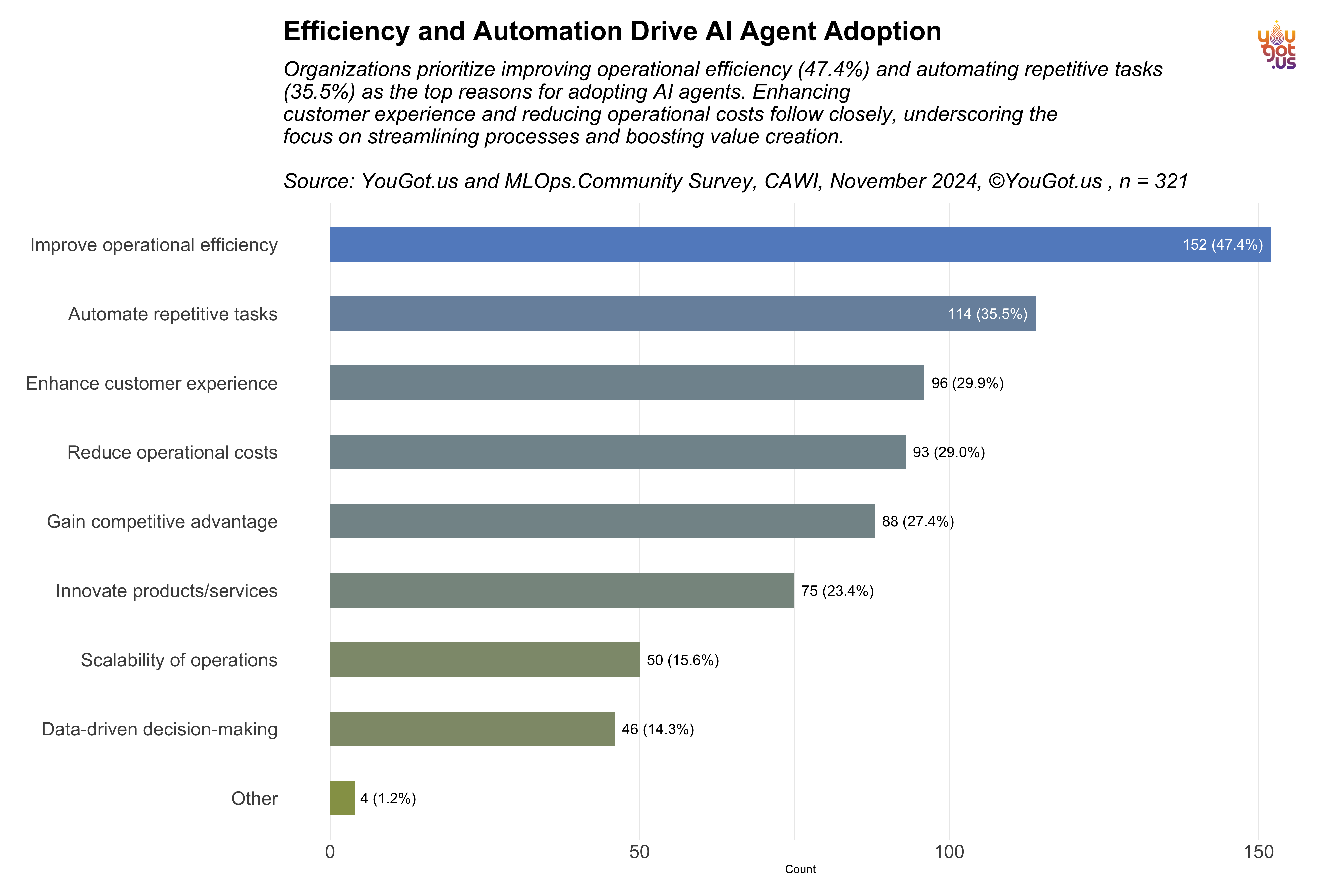

Amid these differences in maturity, our data also uncovers the primary reasons organizations choose to invest in AI agents. Improving operational efficiency (47.4%) tops the list, with many respondents noting that internal processes—from repetitive paperwork to complex data analysis—can be optimized by deploying agents. Close behind is automating repetitive tasks (35.5%), which dovetails with the efficiency theme: tasks that eat up employee time can often be handed off to AI, freeing staff to focus on strategic or creative work.

Next in line is enhancing customer experience (29.9%), underscoring that many companies aim to improve response times, personalize customer interactions, and reduce wait times with AI-driven chatbots or support agents. Reducing operational costs (29.0%) is another leading factor—especially for larger organizations that face high overhead for human-intensive tasks.

Interestingly, innovating products and services (23.4%) and gaining competitive advantage (27.4%) also rank highly. These motivations indicate that organizations see AI agents not just as a tool for incremental improvements, but as a pathway to developing new offerings or differentiating themselves in crowded markets.

From Pilots to Production: Technical, Strategic, and Cultural Factors

Even for those who see clear value in AI agents, scaling up from pilot to full deployment isn’t trivial. On the technical side, many cite challenges with integrating AI agents into existing systems, particularly in sectors like finance or healthcare, where legacy infrastructures and stringent regulations abound. Coupled with the complexity of data pipelines, robust DevOps or MLOps practices become essential to ensure performance and security at scale.

On the strategic front, leadership buy-in is often the deciding factor. Early-stage startups, as we’ve seen, move quickly if a founder or CTO drives adoption. Larger enterprises might require board approval or a strong internal champion to secure budget allocations. Organizations that effectively measure ROI—through faster response times, higher customer satisfaction scores, or reduced manpower for repetitive tasks—tend to find it easier to justify expansion.

Culturally, security remains a top concern, particularly where sensitive data is involved. Lengthy compliance checks can stall projects for months, especially in regulated industries. Employees also express apprehension about job displacement. However, many early adopters stress that human oversight remains crucial—AI agents help scale routine tasks but don’t eliminate the need for human insight, particularly in complex decision-making or customer interactions.

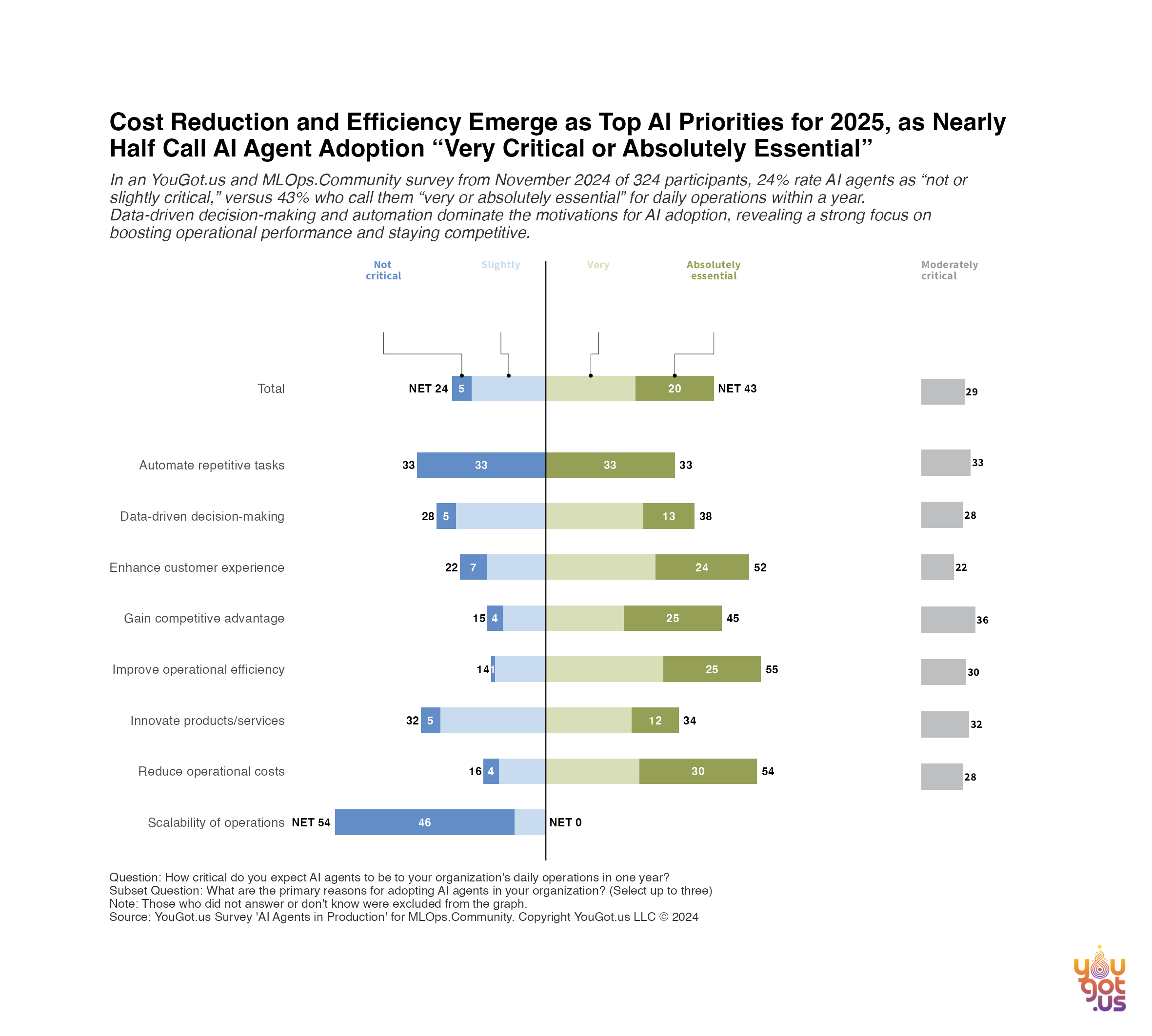

Shifting Priorities: Cost Reduction and Efficiency on Top

When we asked respondents how critical they expect AI agents to be for daily operations in the next year, nearly 43%called them “very or absolutely essential.” In tandem with that rising sense of importance, two priorities now stand out: cost reduction and operational efficiency. Over half of respondents emphasize the need to keep budgets lean, pointing to AI agents as a way to achieve more with fewer resources—whether by automating internal tasks or streamlining customer-facing processes.

This mirrors larger economic trends. In uncertain times, businesses often turn to technology to bolster the bottom line. AI agents fit that narrative by promising continuous, scalable solutions that can adapt to shifting market conditions. Leaders also see them as a way to boost employee productivity: repetitive, lower-value work can be offloaded to AI, letting teams devote more energy to strategic projects. Nevertheless, a lack of technical expertise and unclear ROI still holds some organizations back, illustrating that even efficiency gains aren’t always enough to overcome risk aversion.

The Road Ahead

So, what’s next for AI agents across these varied landscapes? Startup enthusiasm suggests we’ll see fresh use cases emerge rapidly—especially around coding assistance, lead generation, and customer support—while larger enterprises could methodically expand existing pilots. Market competition remains a potent driver, as companies that adopt AI agents effectively can leap ahead, setting the bar higher for everyone else.

Technological improvements continue apace, with refined language models and frameworks lowering entry barriers. Best practices around model monitoring, responsible AI, and advanced testing will likely accelerate broader confidence in production deployments. Even so, security and integration complexities won’t vanish overnight—particularly for highly regulated sectors.

Ultimately, AI agents may soon transition from an interesting experiment to a strategic mainstay. As adoption climbs, the conversation is no longer if organizations should deploy them, but rather when and how they can do so responsibly and profitably. In the next chapter, we’ll look at the barriers that still impede widespread adoption, examining everything from talent shortages to the intricacies of compliance, and how leading teams are addressing them head-on.

Chapter 4: Key Use Cases and 2025 Focus Areas for AI Agent Projects

While AI agents can serve a broad array of functions—from automating routine tasks to generating deep insights—a handful of use cases have emerged as early winners in our survey data. Understanding these focal points is crucial because they not only illustrate where AI agents deliver immediate value but also hint at longer-term possibilities. This chapter explores how organizations are deploying AI agents today, why certain applications outpace others, and what lessons can be learned for those still evaluating where to start.

Current Usage: Knowledge, Support, and Development

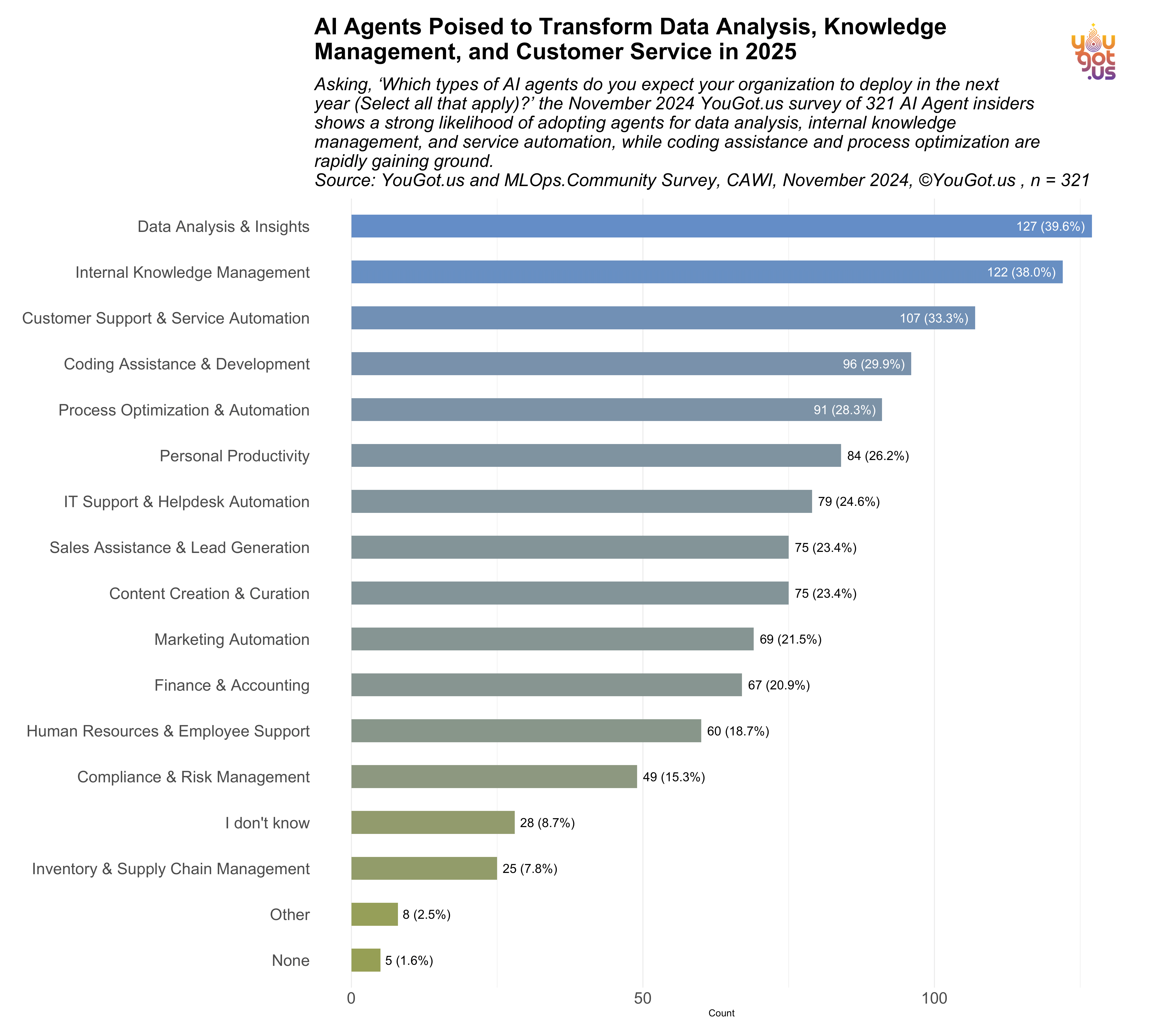

According to our November 2024 data, internal knowledge management, customer support, and coding assistance are the three most commonly adopted use cases. This points to a focus on streamlining information flows, automating customer-facing tasks, and accelerating software development cycles.

Internal Knowledge Management: By organizing wikis, policy documents, and archived data, AI agents reduce the time employees spend searching for information.

Customer Support & Service Automation: Automated helpdesks, chatbots, and ticket-routing systems improve response times and free human agents to handle more nuanced inquiries.

Coding Assistance & Development: Language models help generate code snippets, detect bugs, and even offer architectural suggestions—speeding up prototyping and boosting overall code quality.

These top areas reflect a practical approach to AI: pick the functions that show clear, immediate ROI (e.g., fewer support tickets, faster coding sprints, and streamlined employee onboarding).

Looking Ahead: Usage Goals Over the Next Year

Many organizations aren’t content with the status quo. Our survey reveals ambitious plans for the coming year, with a significant portion of respondents aiming to expand or introduce AI agents into additional domains. This planned growth underscores the belief that AI agents can do more than just handle low-hanging fruit; respondents anticipate rolling out solutions for:

Process Optimization & Automation in finance, accounting, and inventory management—sectors that have historically lagged but see huge potential in reducing manual overhead.

Human Resources & Employee Support, providing chat-based onboarding, skill-development recommendations, and real-time policy clarifications.

Marketing Automation and Lead Generation enhancements, driven by better personalization algorithms and data-driven campaign orchestration.

Many organizations aren’t content with the status quo. Our survey reveals ambitious plans for the coming year, with a significant portion of respondents aiming to expand or introduce AI agents into additional domains. This planned growth underscores the belief that AI agents can do more than just handle low-hanging fruit; respondents anticipate rolling out solutions for:

Process Optimization & Automation in finance, accounting, and inventory management—sectors that have historically lagged but see huge potential in reducing manual overhead.

Human Resources & Employee Support, providing chat-based onboarding, skill-development recommendations, and real-time policy clarifications.

Marketing Automation and Lead Generation enhancements, driven by better personalization algorithms and data-driven campaign orchestration.

However, these aspirations hinge on overcoming key hurdles—ranging from technical integration to compliance. As organizations shift from idea to execution, leadership buy-in and robust data pipelines will play decisive roles in whether these expansions succeed.

Divergent Approaches: Startups vs. Fortune 1000

Digging deeper into our dataset, respondents from early-stage startups (Seed to Series C) frequently report using AI agents for marketing automation (54%) and project management (46%), suggesting a strong emphasis on agility and customer-facing innovation. Participants in these younger companies often mention experimenting with unproven, high-impact scenarios, potentially to gain a competitive edge in fast-moving markets. In contrast, survey data for larger entities—particularly large public tech firms and Fortune 1000 organizations—shows a focus on personal productivity (39%) and content creation (34%), aligning with priorities around incremental improvements and scalable operations. These larger enterprises also cite compliance, security, and risk mitigation as important considerations, which can lead to a more step-by-step approach in selecting and deploying AI use cases.

Early-Stage Startups (Seed to Series C)

Marketing Automation (54%): Younger companies lean heavily on AI-driven customer engagement to stand out in crowded markets.

Project Management & Workflow Tools (46%): Speed and agility are paramount, so these startups automate tracking, resource allocation, and collaboration.

Innovation-Focused: They’re more likely to experiment with high-impact, unproven use cases, hoping to gain a competitive edge.

Large Public Tech and Fortune 1000

Personal Productivity (39%): Larger enterprises tend to focus on improving internal workflows, boosting employees’ daily efficiency rather than overhauling entire processes at once.

Content Creation (34%): While marketing is still a focus, enterprises often aim for incremental improvements—producing or curating content at scale while maintaining brand consistency.

Process-Oriented Mindset: Compliance, security, and risk mitigation often take precedence, leading these firms to tackle use cases in a more step-by-step fashion.

This contrast highlights a divide between fast and innovation-driven startups and process-oriented enterprises. While both see value in AI agents, their risk tolerance, resource allocation, and immediate goals can vary significantly.

Use Case Summaries and Key Takeaways

In our survey sample, coding assistance and internal knowledge management emerged as two predominant applications, with respondents noting quick returns on investment through automated developer workflows and streamlined information retrieval. While some teams expressed initial reservations about allowing AI to handle code, the positive impact on prototype speed and overall code quality eased those concerns. Meanwhile, knowledge management gained traction after participants recognized how significantly AI agents could reduce time spent searching for internal data. Customer support and service automation also accounted for a notable portion of reported use cases, aiming to enhance efficiency and responsiveness.

Despite assumptions that customers might insist on human interaction, a hybrid approach of AI plus human agents proved effective in delivering faster initial responses without compromising empathy. The data further indicated a divide between early-stage firms and large enterprises: startup participants tended to emphasize bolder, outward-facing initiatives such as marketing automation and project management, whereas Fortune 1000 organizations focused on steady improvements to personal productivity and content creation. This divergence in priorities reflects different strategic pressures and appetites for risk, rather than purely technological capabilities.

Next: Part II of this series will focus on models, frameworks and deployments

Citation

@online{garcia2024,

author = {Garcia, Christina},

title = {AI {Agents} {Survey} {Results} {Part} {I}},

date = {2024-12-28},

url = {https://yougot.us/news/2024-12-28-AI-Agents-Survey-Results/},

langid = {en}

}